PowerComply - Transaction

Monitoring Made Simple

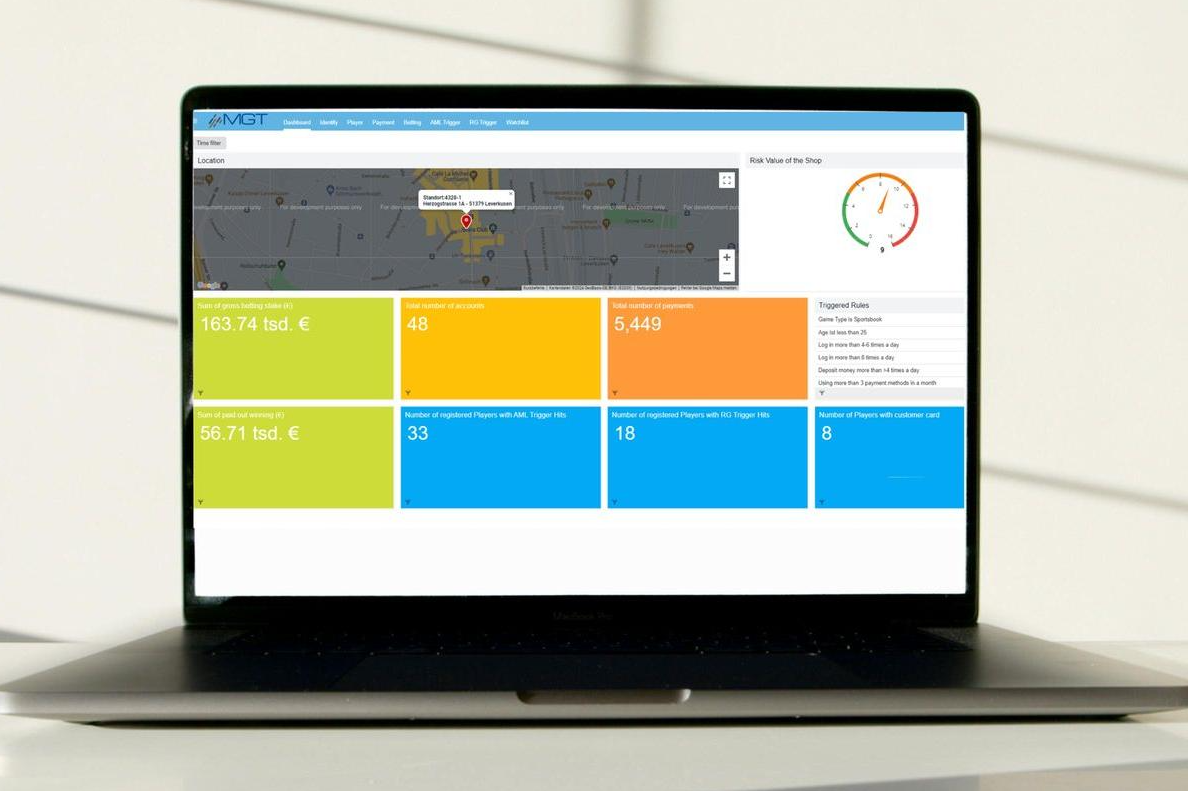

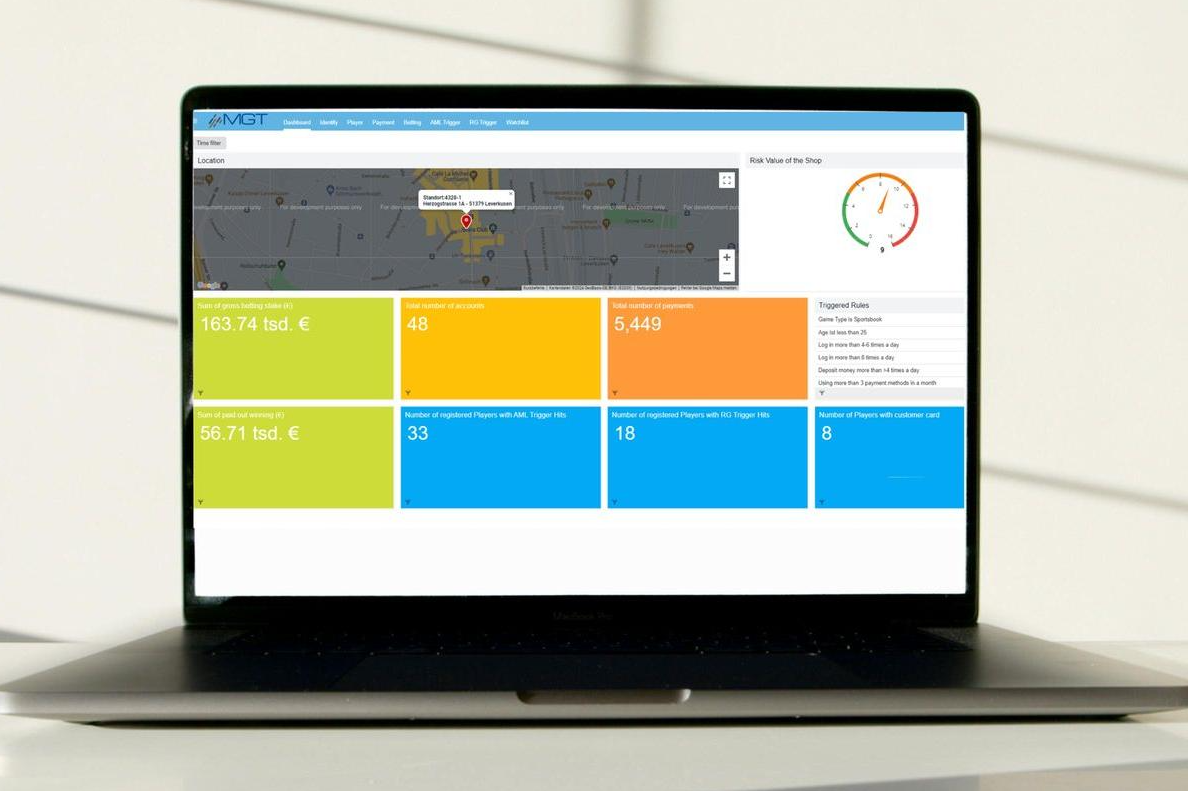

Real-time detection of suspicious activity to help prevent financial crime, manage risk and maintain full AML compliance and Responsible Gambling adherence.

MGT Aggregator - Compliance API for all your needs

The MGT Aggregator is your unified interface to world-wide leading digital compliance solutions.Instead of integrating dozens of vendors separately, access them all through one modular, scalable API.

Simplify Compliance. Unlock Your Potential. Empower Growth. Enter new markets.

PowerComply - Transaction

Monitoring Made Simple

Real-time detection of suspicious activity to help prevent financial crime, manage risk and maintain full AML compliance and Responsible Gambling adherence.

MGT Aggregator - Compliance API for all your needs

The MGT Aggregator is your unified interface to world-wide leading digital compliance solutions.Instead of integrating dozens of vendors separately, access them all through one modular, scalable API.

Whether you’re onboarding players, verifying fintech users, scaling an eCommerce checkout or launching a new digital product - MGT is your compliance layer for regulated markets.

Why Leading Brands Trust MGT?

Standardised compliance MGT Aggregator for all your critical digital compliance solutions. This means one connection meets diverse requirements, from essential identity verification to complex regulatory needs. Our streamlined system gives you instant access to all necessary compliance functions, making operations simpler and more cost-effective.est.

Our solutions are backed by infrastructure based in Germany, giving you top security. This strong foundation ensures your operations are fully GDPR-compliant, reflecting our commitment to data privacy. MGT prioritizes the safety and integrity of your compliance data, providing a dependable base for all your compliance needs.

Benefit from our real-time monitoring and fully customizable dashboards. This gives you clear overview of your AML compliance and digital KYC processes. These capabilities are part of our core compliance software, offering deep insights into your operations. MGT helps you to keep watch over all critical compliance functions, providing full visibility and control.

Benefit from the modular design, built for seamless scalability. It fits both, agile startups and large enterprises, allowing them to grow without issues, adapting to new demands and expanding operations. We ensure our digital compliance solutions remain effective at any scale, providing the exact support you need as your business changes.

Trusted by leading platforms in finance, telco, crypto, iGaming, and eCommerce. These regulated sectors rely on our compliance software for vital functions like digital KYC and cross-border compliance. Our solutions help businesses in these industries meet diverse jurisdictional requirements with confidence, supporting their growth and secure operations across various markets.

Our compliance software uses a developer-first design. This ensures quick integration and onboarding of all our digital compliance solutions. We make it simple to get your compliance layer live, reducing setup time and effort. Our design helps to simplify your journey to cross-border compliance.

Why Leading Brands Trust MGT?

Standardised compliance MGT Aggregator for all your critical digital compliance solutions. This means one connection meets diverse requirements, from essential identity verification to complex regulatory needs. Our streamlined system gives you instant access to all necessary compliance functions, making operations simpler and more cost-effective.

Our solutions are backed by infrastructure based in Germany, giving you top security. This strong foundation ensures your operations are fully GDPR-compliant, reflecting our commitment to data privacy. MGT prioritizes the safety and integrity of your compliance data, providing a dependable base for all your compliance needs.

Benefit from our real-time monitoring and fully customisable dashboards. This gives you clear overview of your AML compliance and digital KYC processes. These capabilities are part of our core compliance software, offering deep insights into your operations. MGT helps you to keep watch over all critical compliance functions, providing full visibility and control.

Trusted by leading platforms in finance, telco, crypto, iGaming, and eCommerce. These regulated sectors rely on our compliance software for vital functions like digital KYC and cross-border compliance. Our solutions help businesses in these industries meet diverse jurisdictional requirements with confidence, supporting their growth and secure operations across various markets.

Benefit from the modular design, built for seamless scalability. It fits both, agile startups and large enterprises, allowing them to grow without issues, adapting to new demands and expanding operations. We ensure our digital compliance solutions remain effective at any scale, providing the exact support you need as your business changes.

Our compliance software uses a developer-first design. This ensures quick integration and onboarding of all our digital compliance solutions. We make it simple to get your compliance layer live, reducing setup time and effort. Our design helps to simplify your journey to cross-border compliance.

Ready to simplify compliance and accelerate market entry?

Let's connect and explore your compliance needs.

Contact Us

Ready to simplify compliance and accelerate market entry?